The Indian pick-up truck market (2- to 3.5-tonne GVW), which recorded sales of around 183,414 units in FY15-16, is forecast to grow to 800,000 units by 2023. This indicates the huge growth potential in the segment, which is why Tata Motors has launched its latest salvo – the Xenon Yodha – at an aggressive price of Rs 605,000 (Single-Cab – BS III) and Rs 619,000 (Single-Cab – BS IV).

Home-grown Mahindra & Mahindra is, by far, the leader in this segment with an overwhelming 65 percent market share. The company’s Bolero pick-up range has, for long, been the flavour of the market with an out-and-out dominance, particularly in rural India.

What’s driving demand for pick-ups in the 2- to 3.5-tonne segment is the speedy growth of satellite towns and expansion of urban India along with new marketing phenomena like e-retailing. As a result, distribution requirements have changed, paving the way for bigger and more powerful vehicles, transporting heavier loads, to cover long distances.

Furthermore, a number of big cities in India have restrictions on CVs of over 3.5 tonnes GVW entering their main precincts during the daytime. This creates an opportunity for pick-ups like the new Xenon Yodha, with which Tata Motors is looking to loosen M&M’s stranglehold on the segment.

Tata Motors has has been fighting it out with the market leader with its Ace family of products including the Super Ace and Tata 207, and also the Xenon pick-up. However, they have done little to disrupt M&M’s continued charge.

New warrior joins the battle

The new Xenon Yodha is Tata Motors’ first product of 2017 and also the first with new brand ambassador for commercial vehicles, actor Akshay Kumar.

The Yodha (which means fighter/warrior in Hindi), is Tata’s fresh attempt to win market share in the segment. The all-new pick-up, which is targeted at a wide range of commercial applications with claimed USPs of high levels of performance and lowest operating cost, is squarely targeted at the Mahindra competition. The Yodha has a rated payload of up to 1,250 kg, is available in 4×4 and 4×2 options in single-cab and double-cab versions, and bears a starting price of Rs 605,000.

To attract smaller entrepreneurs, businessman and traders, the Xenon Yodha has a first-in-segment customised free AMC package of three years/100,000 kilometres, and best-in-industry warranty of three years or 300,000km (whichever is earlier).

Meanwhile, M&M has over the past year strengthened its product portfolio in the 2- to 3.5-tonne pick-up market. In January 2016, the company launched the Imperio, a premium pick-up designed to cater to small and medium business transportation needs, priced at Rs 625,000. Then in April, it rolled out a larger version of its successful Bolero pick-up truck, called the Big Bolero Pik-up with a class-leading cargo body length of 9 feet (2765 mm) and payload capacity of 1,500kg.

How the market stacks up

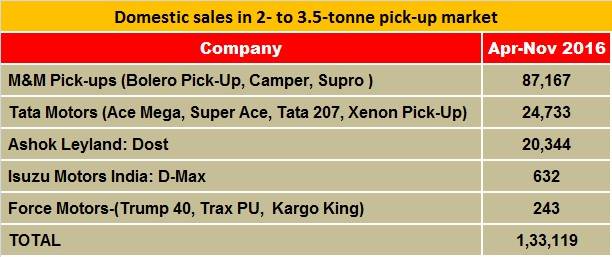

In FY2015-16, the overall 2-3.5T segment sales stood at 1,83,414 units. While M&M had absolute leadership in the segment with a 69 percent share, Tata Motors cornered 15 percent; the next best was Ashok Leyland with 14.8% market share.

For the ongoing fiscal year’s April-November 2016 period, M&M sold 87,167 units but saw its market share dip marginally to 65.4 percent. Tata Motors sold 24,733 units, its market share of growing to 18.5 percent.

Ashok Leyland, the other domestic player with a marked presence in the segment with a single product – the Dost, is close behind Tata Motors. In the April-November 2016 period, the Dost has sold 20,344 units to win a market share of 15.28 percent.

The sole foreign OEM in the segment and a formidable one at that is Isuzu Motors of Japan. Isuzu has a 40 percent share of the 300,000-units-per-annum pick-up market in Thailand, the world’s largest pick-up market and takes second position after leader Toyota. Isuzu is bullish on Indian market and now that its plant in Andhra Pradesh has gone on stream last year with increase localisation, the company is eyeing further penetration in the Indian market.

Whether the new Tata Xenon Yodha can muscle its way and grab market share, particularly from Mahindra & Mahindra, will be known in some months. Expect M&M to also take rearguard action to protect its turf. Another industry player is lining up some new moves for this segment but more on that tomorrow.

Also read: Tata Xenon, Safari part of Rs 460 crore order from Indian defence forces